How To Deal With Overdue Taxes

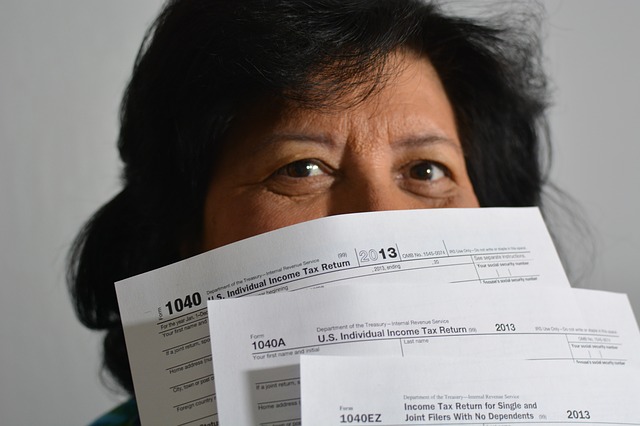

Have you found yourself dealing with a financial hardship that has led you to be overdue on your taxes? If you’ve begun to receive past due notices from the IRS, and you’re not sure how to proceed, it might be time to think about hiring a tax attorney to help you through the process. (Image Credit: Robert DeLaRosa/Pixabay)

When to Hire a Tax Attorney

While you don’t need a professional to handle every tax issue, trained and experienced attorneys can help you with troubles that have legal ramifications and paperwork a taxpayer might not understand, from starting a business to handling back taxes.

If you haven’t paid your taxes on time, the IRS has the right to seek out tax liens, tax levies, and even wage garnishment to settle what you owe. There are, however, ways to negotiate with the IRS before it’s too late. While a layman can handle some issues, a tax attorney can help you with more complicated matters, such as applying for installment plans or an Offer in Compromise.

Where to Find Tax Attorneys

If you do need a tax attorney, you can find many great resources throughout the country to help you deal with your IRS issues, no matter how great or small.

For example, California-based Hurricane Tax has done great work nationwide, receiving an average four-star review from its customers while resolving more than $35 million in tax debt. Like many large firms, Hurricane Tax has tax attorneys, debt specialists, certified professional accountants, and enrolled agents to help clients get quick resolutions in two to six months.

Optima Tax Relief handles all levels of tax debt complications and serves people in all 50 states, plus those living abroad, with an A+ rating from the Better Business Bureau (BBB). The company can communicate with the IRS so you don’t have to, leveraging its experience for your benefit without the higher costs of other firms.

Community Tax has been servings its customers to the tune of more than $400 million in tax debt relief over the 10 years it’s been doing business in the Midwest and beyond. The company specializes in tax liens but can also help its customers with issues such as wage garnishments and applying for Offers in Compromise.

Avoid Scams When Searching for Tax Advice

No matter the level of help you need when seeking assistance from a tax professional, it’s important you avoid devious scammers who look to take advantage of people when they are most vulnerable. Unreliable individuals and companies will guarantee results they can’t deliver to get you to pay an upfront fee you’ll never get back. Make sure you hire a licensed professional who will be honest about what he or she can accomplish and has a reputation for delivering results to their clients.

While not every tax situation is going to call for professional help, if you find yourself in over your head with overdue taxes, don’t hesitate to contact a trusted tax attorney to do the heavy lifting for you.

Leave a Reply